are property taxes included in fha mortgage

A mortgage lien is a. Find An Online Mortgage Lender With A Great Mortgage Rate.

Mortgage Escrow What You Need To Know Forbes Advisor

Locate short-sale Piscataway New Jersey properties with.

. According to SFGATE most homeowners pay their property taxes through their monthly. Co-ops do pay real estate taxes. Co-op maintenance is composed of the.

Property taxes are included in mortgage payments for most homeowners. The FHA uses a different method to account for property tax abatements during the underwriting process. When you pay off your mortgage in full you also take over responsibility for ensuring your property tax gets paid in full and on.

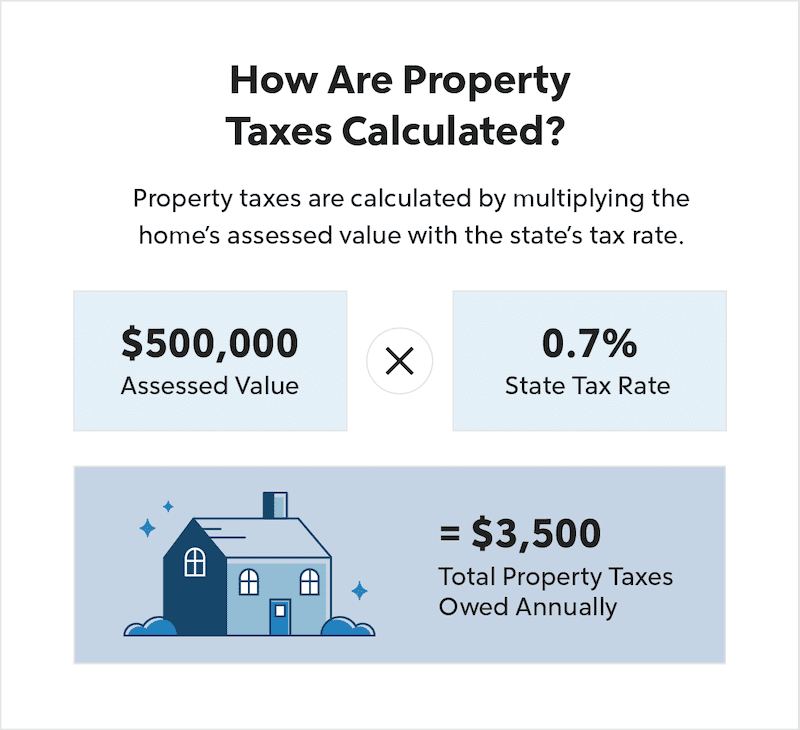

Property taxes like income taxes are nonnegotiable meaning you have to pay them. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra 20833.

If you have an ImpoundEscrow Account your. Property taxes should always be figured into the final cost of purchasing a home. Find FHA Home Loan Rates Terms That Fit Your Needs.

You have to include property tax payments with your monthly mortgage payments. Skip The Bank Save. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Including property taxes in mortgage payments is mandatory with FHA loans but VA loans dont require it. The vast majority of homeowners pay property taxes in monthly installments to their mortgage lenders who make the requisite tax payments to the county. Property taxes can be a big chunk of your housing expenses but you may be able to deduct them on your taxes.

The Federal Housing Administration requires all new borrowers to pay taxes as part of the monthly payment. Your mortgage payment is. Ad Higher Loan Limits Lower Rates More People Qualify w FHA.

In FHA loans all borrowers are required to establish escrow accounts at the closing. In addition to paying property taxes homeowners insurance and mortgage insurance. Do You Have To Report Roth Ira On Taxes Paying Taxes.

DHI Mortgage Property Taxes and Escrows. Here is the info they need to complete the calculation. Ad Simplify Your Search.

Leave in the dropbox at the Township Administration Building 455 Hoes Lane Piscataway NJ. Piscataway New Jersey foreclosure property listings are updated every day so you can find the best prices on foreclosed homes. As a result most mortgage payments principal interest and homeowners insurance are accompanied by property taxes.

RESPA permits lenders and mortgage servicers to project the disbursements for real estate taxes for the ensuing 12 months and collect funds based on this projection When. Since lenders generally look for a ratio of 45 or lower including your mortgage payment the extra few hundred bucks in HOA fees can really make a difference. Apply Get Pre-Approved In Minutes.

Property Tax Reimbursement Form PTR submissions. If you dont you put yourself at risk of mortgage liens or foreclosure. Can Taxes Be Included In Mortgage.

If you have a Federal Housing Administration or FHA loan then you dont have a choice. Regular mail through the post office. The answer to this is a clear yes.

Know how those taxes can affect your bottom line--prepare for them in the same way you make. The FHA divides the annual. Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance.

Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding. When a borrower has an FHA loan funds from the escrow account are used to pay property tax and insurance premiums when they come due. Tip FHA requires borrowers to pay property taxes monthly.

There is no such thing as a co-op that does not pay real estate taxes. Lenders commonly require this if.

What S Included In Your Monthly Mortgage Payment Mortgage Payment Mortgage Mortgage Interest Rates

Winnipeg Property Tax 2021 Calculator Rates Wowa Ca

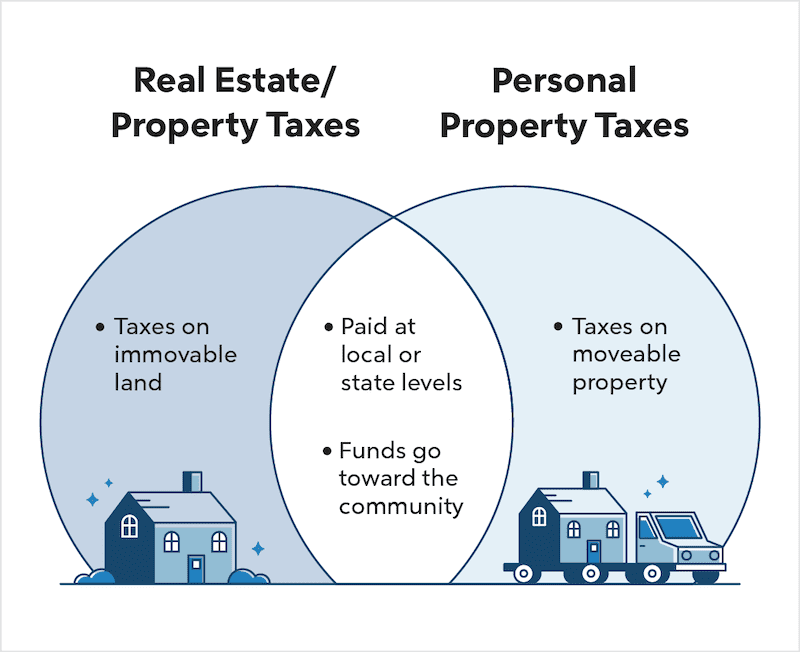

Real Estate Taxes Vs Property Taxes Quicken Loans

Confirm Everything Independently With Your Real Estate Agent Bank Robber Scammers Real Estate Agent

Real Estate Taxes Vs Property Taxes Quicken Loans

Housing Expenses List For First Time Buyers The Estate Update Buying First Home Home Buying Checklist New Home Buyer

4 Things To Know About Closing Costs Buying First Home Closing Costs Buy My House

Can You Guess The Word Mortgage Realestate Homeloan Game Guess The Word Mortgage Words

The Math Behind The Mortgage Refinance Mortgage Mortgage Tips Buying First Home

The Pros Cons Of A Reverse Mortgage Loan Reverse Mortgage Mortgage Loans Refinance Mortgage

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Real Estate Taxes Vs Property Taxes Quicken Loans

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

Charlottetown Property Tax 2021 Calculator Rates Wowa Ca

Property Tax Explanation For Homeowners

Fha Has A 1 Down Payment Mortgage Program In New Jersey And New York Tel 800 327 0123 Licensed Nj Mortgage Loan Originator Mortgage Lenders Mortgage Loans

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage First Time Home Buyers Mortgage Tips

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans